Vinayak Joglekar presents you Takeaways from the Lean Startup Week 2017.

The main highlight of the conference was the new book “The Startup Way” authored by Eric Ries. It was released in the week preceding the conference; and I was pleasantly surprised to be able to buy a copy from a bookshop in the Hong Kong airport. I finished reading the book on the long flight to San Francisco and was all set to hear more about it from Eric himself. I was in for yet another surprise when as a part of the conference kit I got a hard bound copy of the book, which then I got signed by Eric.

The book significantly captures how a passionately motivated team trying to solve a problem under conditions of extreme uncertainty can apply the principles of “The Lean Startup” – even when the team is inside an institution such as a large corporation, government or a social enterprise. The common idea is that any hypothesis can be validated by conducting a controlled experiment. These are low cost, short iterations of a few weeks with each ending in success or failure. In either case, the end result is that the team acquires some validated learning at the end of each iteration.

“The Startup Way” introduces some new concepts. “Innovation Boards” are senior stakeholders within the institution who act like venture capitalists (VCs) for the internal startups. They decide whether a proposed startup is worth investing in. Once the decision is made, they hold the “intrapreneurs” accountable by reviewing progress on a regular basis in “Pivot or Persevere” meetings. The Innovation Board may decide to release the next round of funding or to kill the startup based on the value of “validated learning” by the startup. The board gives complete freedom to the startup in utilizing the funds. But the startup has the onus to use the funds judiciously so as to achieve demonstrable validated learning so that they can go back to the board for the next round. This method of funding is called “metered funding.”

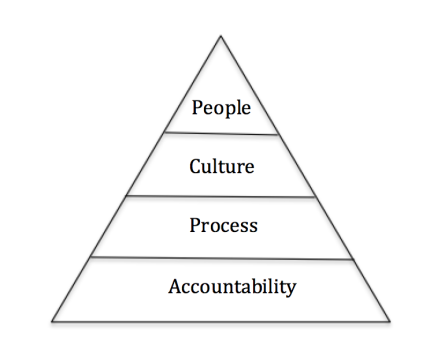

As one can see, accountability is the foundation. The process is designed so that it builds the culture needed to motivate and empower people. The author gives more detailed explanations in the book, but the pyramid below shows the order of priority and significance associated with the four concepts.

Accountability is the foundation

In an earlier article, I had discussed the problems with hierarchies and various options being evaluated. The discussion was inconclusive and we remained with admitting that no single structure can replace the hierarchies. “Horses for courses,” as suggested by Tathagat Varma, was the conclusion.

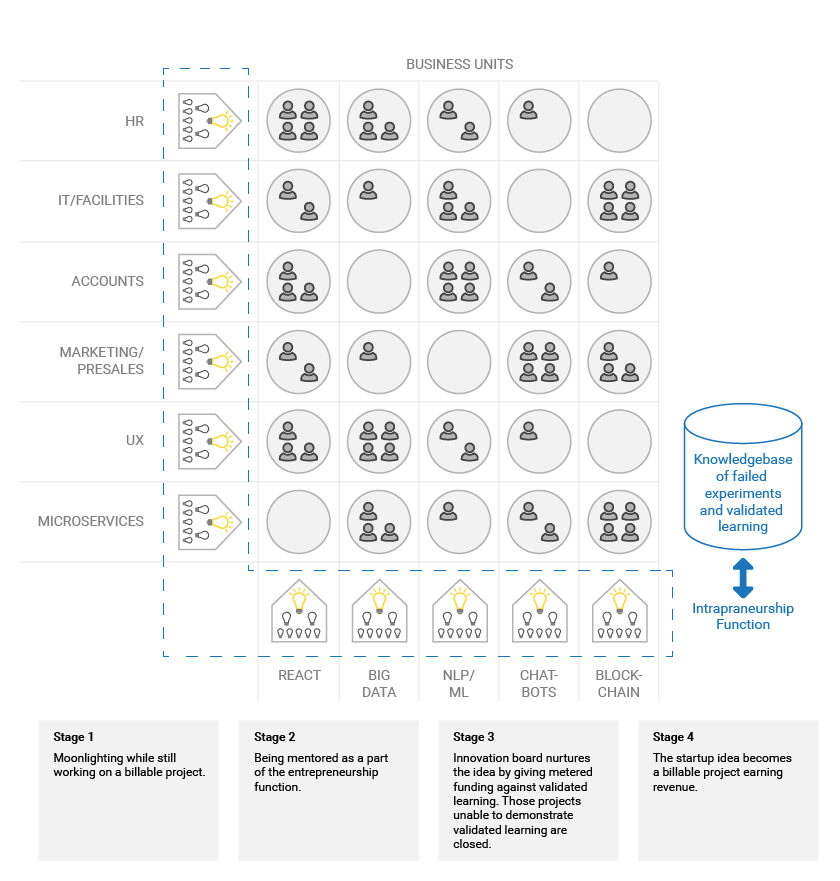

“The Startup Way” seems to have taken this thought one step further by suggesting a perpetually transforming organization that spins up startups to deal with the challenges as they come up. Some startups will succeed and others will pivot or die. This dynamic structure behaves more like a tree and less like a tower. The process of transformation itself is a series of lean startup style experiments. The diagram below describes the structure in more detail..

Organization Structure based on “The Startup Way”

Startups can be nurtured within the project teams with ambitious and passionate individuals hiring team members and “moonlighting” their way to launch. At some point this team would get blessed by the Innovation Board with a round of metered funding. This means the money comes with strings attached. The Innovation Board would ensure survival of the fittest by continuing to fund only the few deserving startups. Finally the successful startup would become an integral part of the organization by becoming a revenue earning, profit making project team or business unit.

The entrepreneurship function is just like any other staff function, such as marketing or finance. The functional head is in charge of a knowledgebase of validated learning gathered from failed experiments. He or she will also ensure that the innovation boards do their job of guiding and nurturing the intrapreneurs.

Everything that is written in the book is supported by actual work done in several large conglomerates, like GE and Citibank. Its very hard to judge the level of success given the size of these organizations since most of the evidence is anecdotal. “The Startup Way” brings hope to the large hierarchical dinosaurs that they could metamorphose into nimble and vastly more intelligent forms.

The biggest takeaway from the book is the accountability that lies at the foundation of the transformation. It brings some sense of control to the whole process of experimentation which is likely to run amok in endless iterations. Measuring validated learning by monitoring a leading metric which serves as a proxy for the net present value is at the center of innovation accounting. The proxy metric also needs to be corrected by accounting for the probability of it actually resulting into a certain net present value. This makes it easy for the innovation board to do apples to apples comparison between various opportunities competing for the next round of metered funding.

| Execution | Behavior change | Customer Impact | Financial Impact | |

| Are the founder and the team committed and stable? Has the team spent enough moonlighting hours on baking the idea? Does the idea pass the test of basic commonsense? | Do they have a well defined business plan canvas? Do they know their LOFA? Do they hold P & P meetings? Do they run their experiments properly? | Is there a recorded impact in terms of customer satisfaction? Shorter cycle time? Monetary savings? Customer referrals? | NPV of business model. Productivity gain? Savings? | |

| Business Unit | What is the % of employees in startups? What is the % of startup founders in this BU? | What are the number of successful projects in the BU? Does the BU have mechanism of celebrating failures and capturing the learning? Employee morale? Per project cost? | Average time taken by projects before first customer demo? Average cost incurred before first customer demo? | Growth of BU revenue? Billable Head Count? Total Valuation of all projects incubated by the BU. |

| Company | What is the % of employees in startups? % of startup founders in the company? | Success rate? Is everyone talking about LOFA , Experiments and NPV? Number of pitches to the innovation board? Is the process simple? | Are we able to attract better talent? Is it impacting net promoter score? Are the number of red days zero? % of deep green accounts? New products launched? | Value of phantom stock, Growth in revenue , billable headcount and EBITDA, % of resources on bench |

The cells in the table suggest some leading metrics for each stage from execution to behavior change to customer impact to financial impact.

In the end, I would like to leave the readers with a quote from Jack Welch: “If the rate of change on the outside exceeds the rate of change on the inside, then the end is near.”