Bespoke portfolio management, rebalancing, and reporting solution built using the Salesforce platform

“Excellarate helped us save considerable time with the software it developed for us.”

Bill AnginoEVP and Chief Compliance Officer, Fischer Financial

The Client

Established in 1988, Fischer Financial is an independent investment management firm located in Harrisburg, Pennsylvania. The firm specializes in investment management services for its clients. Fischer Financial serves institutions, high-net-worth individuals, and business owners across the entire nation and has 29-years of GIPS compliant results.

The Challenge

Fischer Financial Services is a boutique firm that specializes in investment management. They strive to have a high level of personalization for each client which makes automation challenging. In addition, the sheer volume of data for managing over one thousand accounts for hundreds of clients is overwhelming. Reporting is also a challenging task with manual processes and portfolio management software that is over three decades old.

They have researched the most popular off-the-self software solutions over the years. The fatal flaws in all these solutions were their one-size fits all approach. Some examples of these inadequacies include: an overwhelming initial setup, tending to over-trade with a complicated tolerance band setup, lack of “true” automation and creating extra work by having to manage models and assignments. Fischer Financial leverages the latest technology to keep a low headcount, but they face several operational challenges.

Due to the changes in the advisory landscape in recent years, some of Fischer’s most significant challenges include the rising costs of employees, converting complex manual tasks into automated solutions, adapting to changes in technology, and managing and retrieving the data they need.

“Excellarate helped build a universally useful framework and customized it with unique features we wanted in place of a few standard ones.”

The Solution

Operational efficiency is a cornerstone of Fischer Financial’s business. However, COTS (commercial off-the-shelf) solutions are rife with inefficiencies, and Fischer needed a ground-up solution. Using Salesforce’s reliable platform, technologists at Excellarate helped develop a customized portfolio management, rebalancing, and reporting solution.

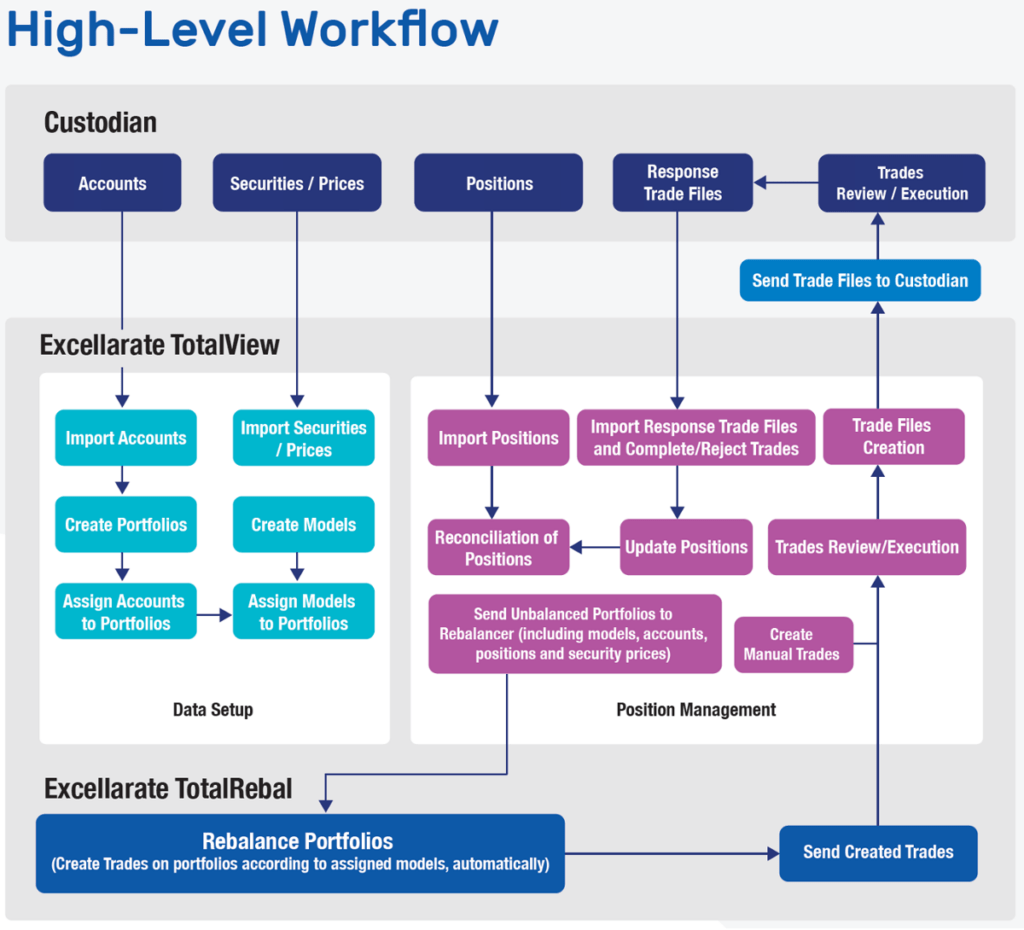

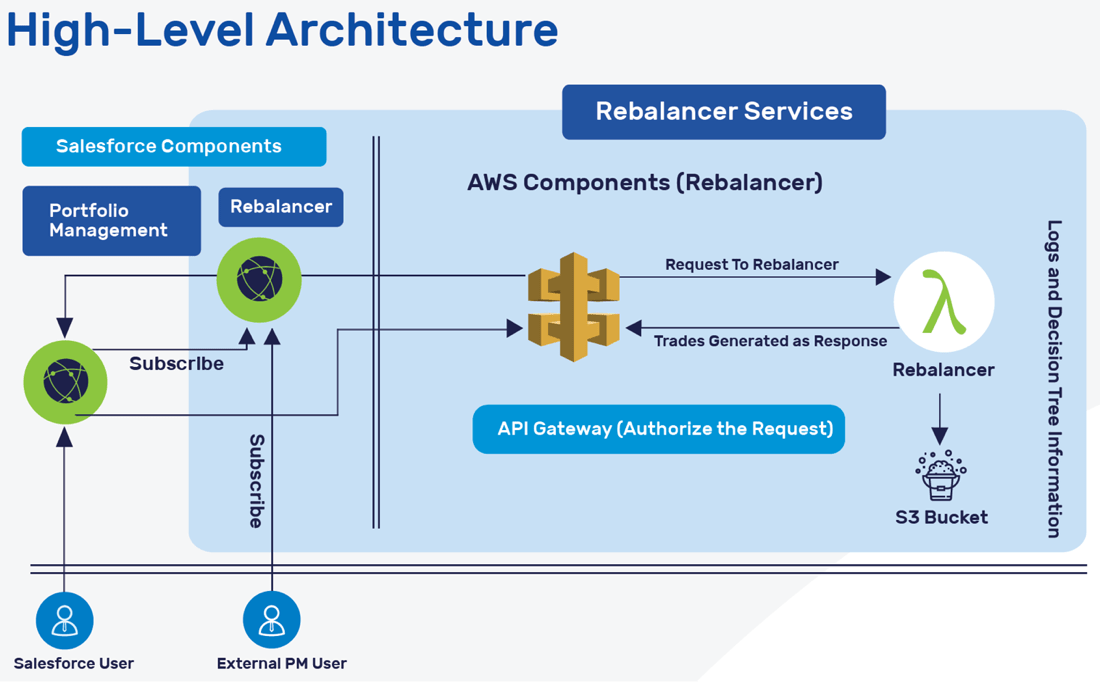

Excellarate’s TotalView framework helped accelerate product development, decreasing time-to-market, lowering build costs, and rapidly building out a customized solution. TotalView is an intuitive, cloud-based, high-performance solution that allows for viewing and maintaining portfolios, accounts, and holdings. TotalView is a modern, robust, and scalable solution.

Combined with Excellarate’s TotalRebal framework, creating and assigning models at the account level is easy and so is trading and rebalancing against those models to maximize the client’s overall portfolio performance. This combination also eliminates the need to piece together disparate functions from multiple vendors and is a single turn-key solution that not only supports portfolio management and rebalancing, but ties in basic CRM capabilities as well.

Excellarate’s TotalRebal is a cloud-based, affordable, high-performance platform that provides portfolio rebalancing as a service (RaaS). TotalRebal helps to automate the rebalance function for its clients using a fully integrated REST API that exchanges JSON formatted messages to automatically create buy/sell trades according to predefined model strategies.

It also supports model management at model and asset group levels allowing the user to maintain security sets, trade rules, and customized system settings/preferences at the firm and portfolio levels.

The Outcome

Complex solutions are challenging to deploy with generic tools. Anticipating and adapting to changing needs eliminates the need to retrain staff. This elimination led to better buy-in and adoption from staff that use these systems daily. Regularly incorporating Fischer’s feedback helps them build a product that gets better as it is used.

Leveraging a collaborative strategy, Fischer Financial and Excellarate work together to build frameworks that springboard the development of custom solutions to facilitate:

Model Creation & Maintenance

- Customized models with up to three levels

- “Model of models” support

- Dynamic model allocation

- Copy model functionality

Portfolio Rebalancing

- Raising/spending cash, custodial cash support

- Rebalancing sectors and asset classes

- Rebalancing all holdings vs. single security

- Rebalancing only over-weighted/under-weighted securities

- Rebalancing to target with configurable tolerances

- Rebalancer generated trades by account, including approval workflow

Trading

- Minimum trade rules for cash, shares, percent of account

- Don’t buy, don’t sell

- Redemption fees

- Wash sale support

- Equivalence/alternate security support

- Support for uploading trade files or executing real-time trades

- Block trading and allocation support

Reconciliation

Performance Reporting

Tech Stack

- TotalView: Core Technology Stack – Force.com, Visualforce Pages, Apex Classes

- TotalRebal: Core Technology Stack – AWS, Lambda, S3, Node.js, RESTful API